How Aging Homes Affect the Property Claims Ecosystem

When we look around neighborhoods in the United States today, it’s clear that our homes are aging—and aging fast. In fact, according to the U.S. Census Bureau, nearly 52% of American homes were built before 1980, and almost a third were constructed before 1960. Older housing not only presents ongoing maintenance challenges, but also directly impacts property claims—often in ways homeowners and even insurers might not expect.

Material Choices: Then vs. Now

According to the Joint Center for Housing Studies of Harvard University, 49.5% of the owner-occupied stock was built before 1980. That means a significant portion of today’s property claims still involve aging, often discontinued materials—especially roofing, flooring, and siding. For adjusters, this underscores how vital it is to identify materials accurately and understand their availability in today’s market. Knowing what you’re dealing with from the start can be the difference between a delayed settlement and a fast, smooth, and informed claim resolution.

Climate Change, Inflation, and Economic Shifts

Recent trends in climate, economic volatility, and inflation compound the challenges posed by aging housing stock. Climate-related events like hurricanes, severe storms, and wildfires have increased in both frequency and severity, worsening wear on already-vulnerable older homes. According to the National Oceanic and Atmospheric Administration (NOAA), billion-dollar weather and climate disasters have dramatically increased over the past decade. These events disproportionately affect aging properties with outdated materials.

Moreover, inflation and ongoing economic shifts have surged building material prices. The National Association of Home Builders reports lumber price increases of up to 81% since 2020, significantly influencing new home costs. Older homes that require more extensive renovations or repairs due to wear or outdated construction methods incur even greater costs amid such volatility.

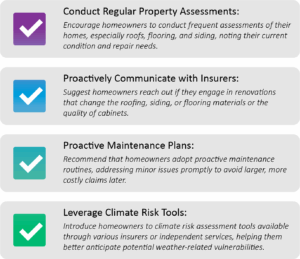

Tips for Insurance Carriers: Guiding Homeowners Through These Trends

Given these shifts, insurers play a crucial role in advising homeowners on proactive steps to manage property risks effectively:

Looking Ahead: Managing Aging Homes and Claims

The intersection of aging housing, rising material costs, and climate impacts has never been more relevant. Property insurance professionals must remain vigilant, staying ahead of these evolving challenges to effectively manage risk, support policyholders, and ensure accurate, fair claims resolution.

At itel, we offer insurers and adjusters a unique advantage in navigating these complexities through precise material identification and accurate, real-time pricing solutions. Our comprehensive data, spanning flooring, roofing, and siding materials, not only promotes fair claim settlements but also empowers adjusters and insurers to provide homeowners with timely, relevant guidance—reducing friction and enhancing clarity in every step of the claims process.